OUR BLOG

Welcome to our financial blog, where we empower you with the knowledge and tools you need to take control of your finances and achieve your dreams.

In a world brimming with opportunities for philanthropy, making charitable donations is a powerful way to create positive change and leave a lasting impact on the causes you care about. However, the impact of your charitable giving can be significantly enhanced when approached with intentionality. Intentional charitable giving goes beyond

The human mind is incredibly powerful – are you fully utilizing yours in support of your financial goals and dreams? If you’d like to cultivate a stronger money mindset, this article is for you. Specifically, we’ll talk about shifting to an abundance mindset, centered on gratitude, which can be a

Inflation has been a hot-button issue in finance and politics lately. You may have noticed changes in inflation yourself if you went to buy something and it was much more expensive than you expected. Eggs are a great example of this.[1] In 2022 the price of eggs went up by

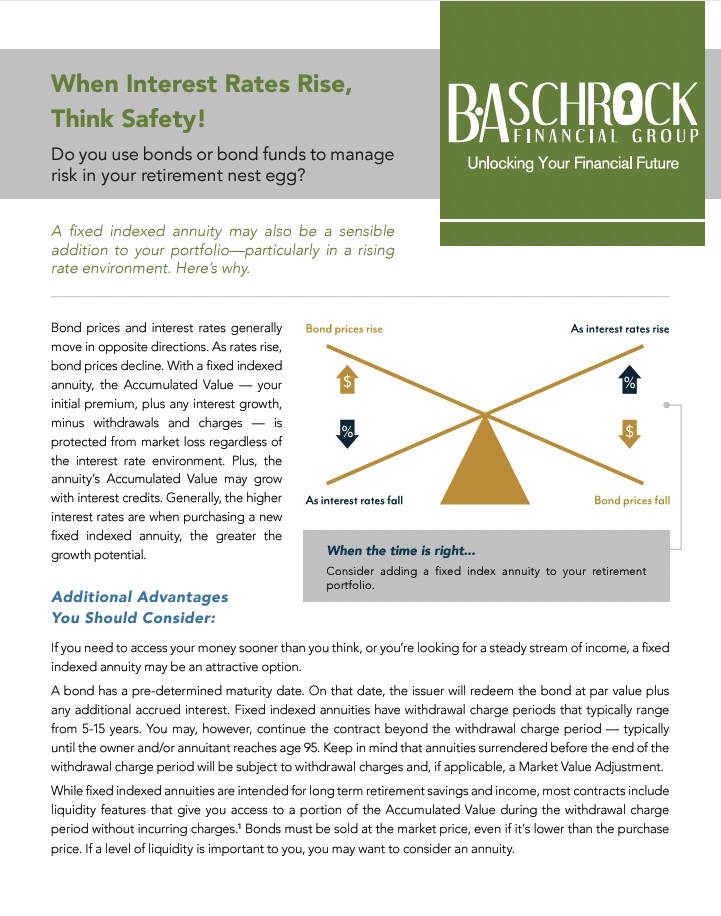

How you handle taxes and when you are taxed are two of the most important factors when it comes to retirement planning. If you are putting together the puzzle pieces of your retirement plan and you are curious about some strategies related to taxes and retirement, here are some possible

The current rate of monthly savings across America is currently at 4.6%. This means that most Americans are saving about 4.6% of their monthly income. This number is unusual as the average amount is almost double that number at 8%. Also, in June, this number dipped to a 15-year low

What is the National Debt Ceiling? The national debt ceiling is the amount of money that the United States Government is allowed to borrow to pay for its expenses. These expenses include things like Social Security and Medicare benefits, tax refunds, military salaries, and interest payments on outstanding debt the