OUR BLOG

Welcome to our financial blog, where we empower you with the knowledge and tools you need to take control of your finances and achieve your dreams.

Building a life together with another person can be a beautiful journey that involves shared dreams, goals, and aspirations. As a couple, you embark on a path of mutual support, where each decision you make impacts not only the present but also the future you’re crafting together. Long-term financial planning

In the journey of life, finding a partner with whom you can share your dreams, challenges, and accomplishments is a remarkable and cherished experience. As a couple, you build a life together, nurturing a relationship that is grounded in love, trust, and mutual support. Just as you work together to

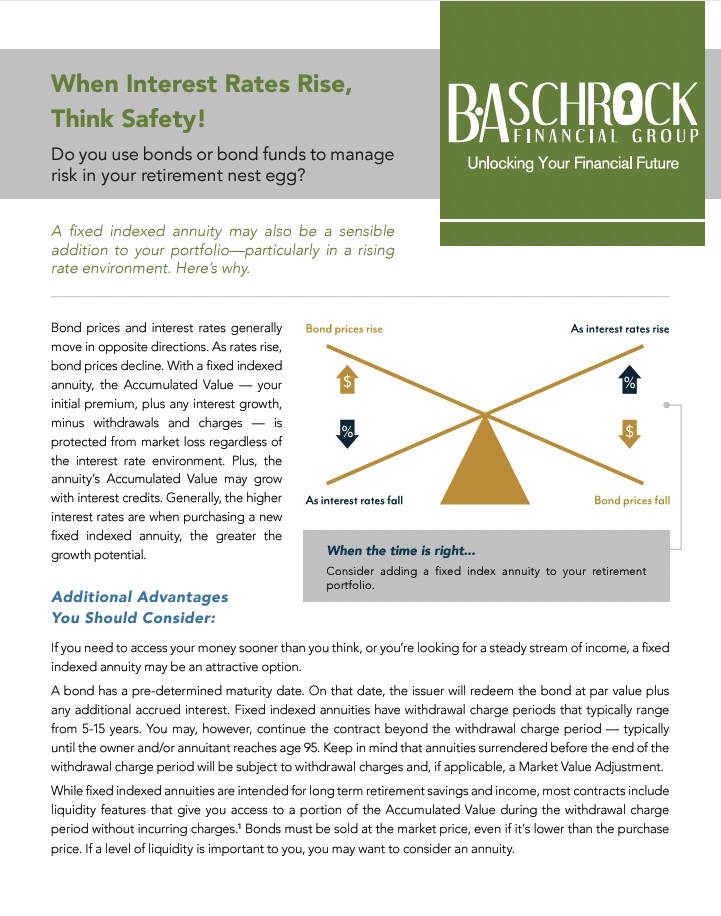

As you set your sights on a new year of financial growth and stability, it’s essential to consider strategies that can enhance your tax efficiency while securing your financial future. Annuities, often hailed for their potential to provide a reliable income stream, also play a significant role in optimizing your

As the New Year dawns, it brings with it the promise of fresh beginnings and new opportunities. For those approaching retirement, this is an ideal time to take steps that lead to a more fulfilling and secure retirement. Your retirement years should be a time of joy, relaxation, and exploration,

As the year draws to a close, it’s an opportune time to reflect on your financial journey and set the stage for a secure and prosperous future. Year-end financial planning is more than just crunching numbers; it’s about achieving peace of mind by organizing your finances, setting goals, and making

In the realm of finance, investing is both an art and a science. It can also be a key aspect to securing a prosperous financial future. However, you can’t just “set and forget” your portfolio. Much like an architect reviewing blueprints before construction begins, assessing your investment strategy is an